Technology News | Tech Library & Resources

Create Beautiful Websites, Affordable Hosting, Free Images, Free WordPress Themes & Plugins, Domain Name Register, Free Games, Image Editors & more.

A Team of tech-savvy people, always ready to provide you the most accurate information and tested solutions for any tech questions.

Your Technology Knowledge Base

OUR SERVICES

WEBSITE CREATION

Web Design, Web Development –

You can create unique websites of high quality by combining over 100 designs with a wide range of applications. You can also easily integrate tools to sell online, send email campaigns, or advertise on the web.

WORDPRESS TOTAL

WORDPRESS WEB DESIGN & HOSTING: You want to ensure that your website delivers an exceptional user experience by having a clean design, fast loading times, and flawless performance. It is easy to maintain and modify as needed.

IMPLEMENTATION OF SEO TECHNIQUES

SEO is aimed at driving traffic, as well as targeting the conversion ratio for your website. Edits can be made as needed without extra charge.

Proper keyword usage in content and plugin installation, such as Google XML Sitemaps and Yoast SEO, can help you achieve your SEO goals.

On-Page SEO – Search Engine Optimization Monthly Package:

In setup phase, we perform these activities:

1. Keyword Research

2. Meta Development/Improvement

3. Home Page Content Development/Optimization

4. HTML Optimization (Site’s structural improvement, URLs standardization, Alt tags configuration, internal linking review, custom 404-page setup, text readability testing, robots.txt optimization, site’s load time review and CSS & HTML code errors correction (Not applicable for template changes)

5. Sitemap creation (both HTML and XML)

6. Canonicalization

7. Search engines submissions

8. Webmaster and Analytics setup

OFF-Page SEO Professional:

Articles/blogs

High Authority post/link Submissions

list in Classifieds

Add to other Business Profiles

Open Google Business Account

Work on Google Map traffic & MORE…

Social Media Management:

MAINTENANCE AND UPDATING

This ensures that the performance of your website is excellent by providing constant improvements in user interaction. Personalized mail-in assistance is offered for all of the website’s tools and services.

ONLINE SHOP AND SHOPPING CART

In addition to having very thorough plans to create a website with an online store and shopping cart, we also have plans to establish an SSL certificate, integrate with WooCommerce, set up payments through PayPal, Visa, Mastercard, or American Express credit cards, accept payments by direct bank transfer, payments by check, and drop-ship payments.

EFFECTIVE USE OF ADD-ONS

Automatic tasks can be done thanks to that: spam comments are blocked, Google Analytics collects website traffic statistics, databases are backed up, content management tools are available, websites load quickly, translations are provided into other languages, chat windows are used for live chats, and so on.

PLANS FOR GOOGLE ADVERTISING

Hire advertising campaigns to appear in Google Ads search results and on the Display network to reach more customers. You can hire advertising campaigns from any plan to appear in Google Ads search results and on the Display network through the most relevant keywords for your topic or business. Your website can grow as much if you want. Customers seeking your services or products can be effectively reached.

MORE TOOLS UPGRADES AND OPTIONS

Update WordPress plugins, update woocommerce, joomla, php etc as needed to keep technology upto date and functioning! An autoresponder can help a growing business increase sales and provide secure payment services by allowing customers to sign up for email marketing campaigns and receive automatic replies.

MORE CONTENT FOR YOUR WEBSITE

We offer assistance and support from the pages created in each plan so that you can add more content. It’s as simple as copying and pasting from your account. You can add text, images, music playbacks, blogs, propaganda, call to action, image galleries, comments, contact forms, counters, stores, price lists, search engines, social network followers, and much more.

SAYOHO TECHNOLOGY BLOGS, HOW-TO & REVIEWS

23 Best Stocks to Buy Now | Cheap Stocks To Buy Now

How to find best stocks to buy now? The Nasdaq Composite index has experienced a significant increase of more than 30% in the past … Read more

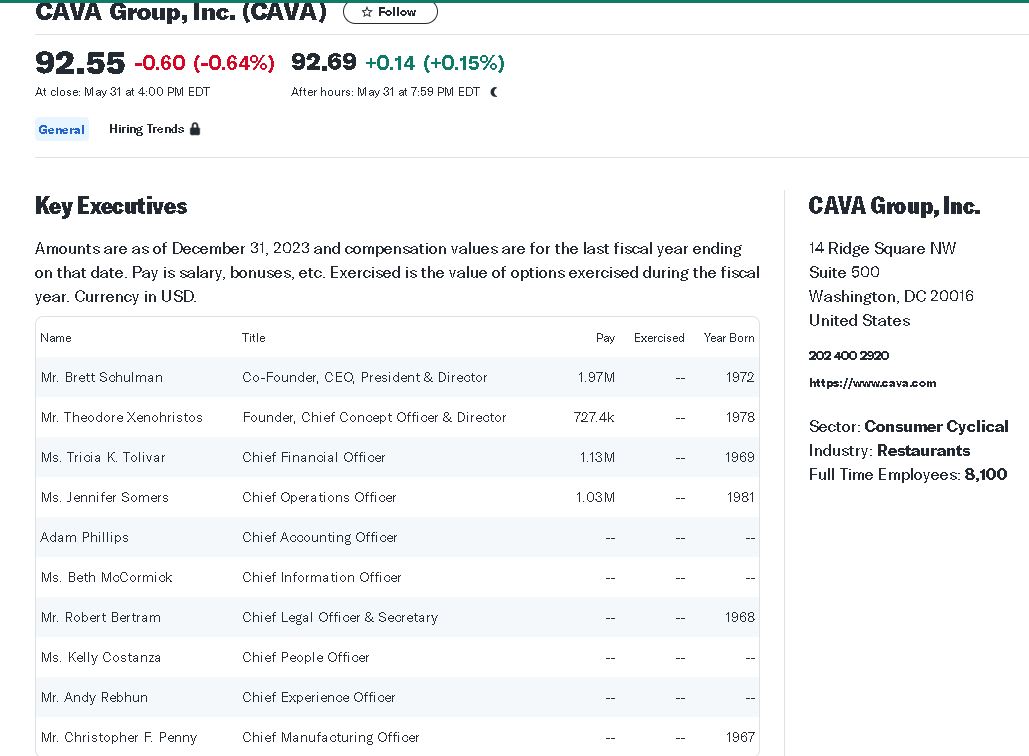

Nvidia And Cava Among Best Stocks | Stock Screener Highlights Top-Rated Industry Leaders

Nvidia - Based on 39 Wall Street analysts offering 12 month price targets for Nvidia stock in the last 3 months with average price … Read more

Solana Price Prediction | Solana ETF

Solana could surge to as high as $312.57 by the end of 2024 if bullish patterns continue. But before we talk about Solana price … Read more

What is AVAX Crypto and How can You Become Rich with AVAX Crypto

Let us find out the answer about What is AVAX Crypto. Avalanche (AVAX) serves as the intrinsic digital currency on the Avalanche blockchain platform, … Read more

What Is DEFI | Decentralized finance (DeFi) | FAQ With Video

One space in cryptocurrencies attracting large consideration is DeFi or decentralized finance. Before we dive into this topic of What Is DEFI, we alos … Read more

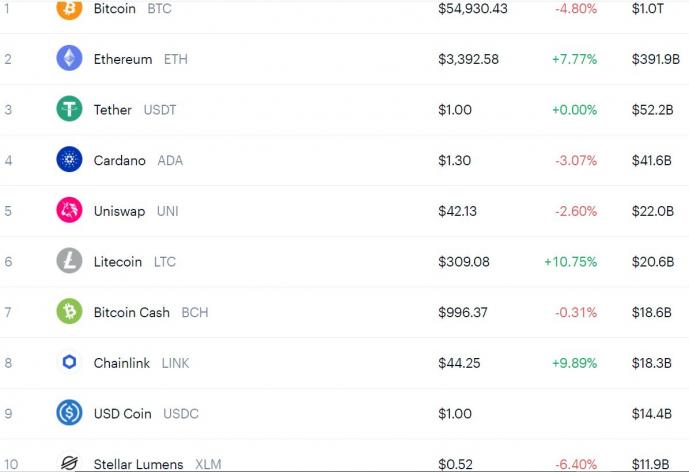

Which Crypto To Buy Other Than Bitcoin? Latest Crypto News

Bitcoin — all the craze since first crossing the $1,000 worth mark in 2017 — is the least thrilling crypto asset in the marketplace. … Read more

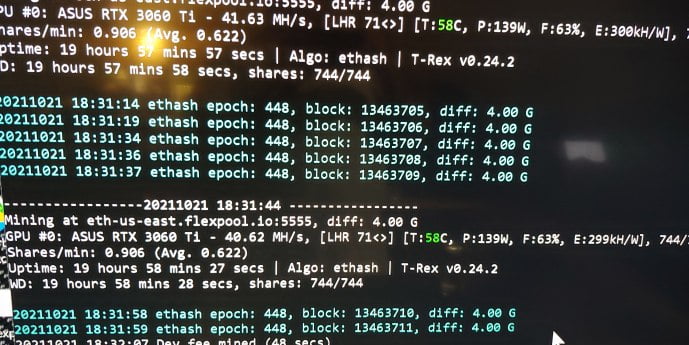

How To Mine Ethereum | Is It Easy To Mine Ethereum | Is Ethereum Worth Mining

What is Ethereum? Ethereum is a decentralized platform that runs smart contracts, applications that run precisely as programmed with out chance of downtime, censorship, … Read more

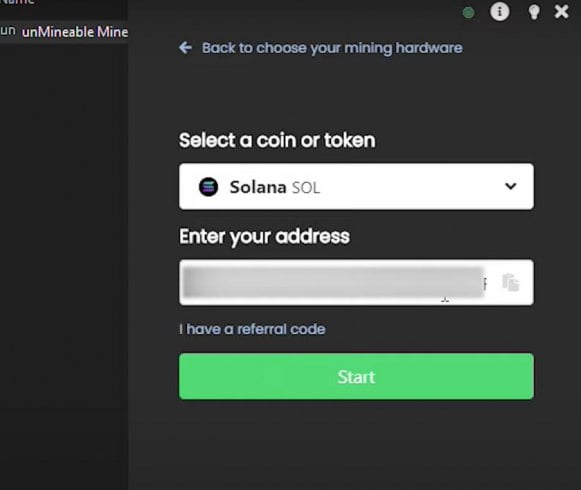

Can you mine Ether ? How To Mine Cryptocurrency

This article is all about how to mine cryptocurrency using GPU also called Graphics Processing Unit. There are many methods to mine cryptocurrency and … Read more

How To Invest In Bitcoin? If I Invest $100 in Bitcoin Today

Introduction: What is Bitcoin? Bitcoin is a type of digital currency that has no physical form and only exists on the internet. Bitcoin is … Read more

LIMITED OFFER!

Super Special Offer on the Total E-Commerce Plan (1 Year)

Our Scalable Plans allow you to Sell Online and Develop your Business as much as you want

– SayOho Team

Turn on your Idea or Business with a 100% Manageable Website

INTEGRATE DESIGN, ADVERTISING, SALES AND MARKETING FROM THE SAME PLAN | ABILITY TO ADD MORE CONTENT | SWITCH PLANS AND GET MORE RESOURCES

Work With US

Stay updated and see our current projects. We are hiring talented web developers & designers!

Our Team

We are group of Tech Savvy nerds who love Web design & creation, SEO, blogging, reviews.

We Are All About

Web Design, Hosting, Reviews, Tech News, How to, VPNs, Tips & Tools, MAC, Android, IOS, Tech Solutions.