Solana could surge to as high as $312.57 by the end of 2024 if bullish patterns continue. But before we talk about Solana price prediction, it is important to understand what is Solana blockchain and what Solana crypto does?

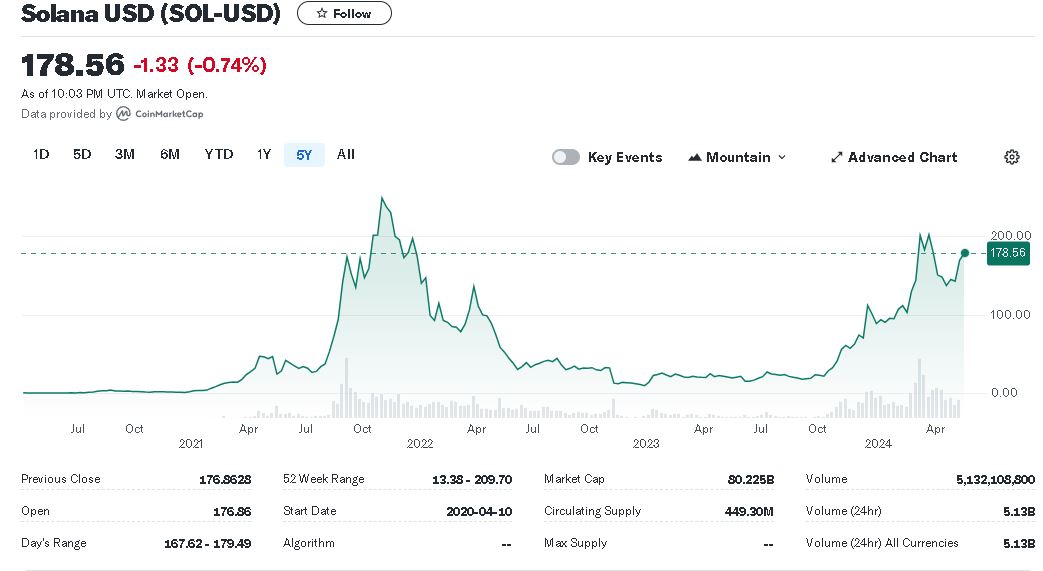

Also like any other crypto currency, Solana is also very volatile as seen in below 5 years Solana to USD chart from Yahoo finance.

What is Solana blockchain?

Solana is a high-performance blockchain platform designed for decentralized applications (dApps) and crypto currencies. Here are some key aspects of Solana:

1. High Throughput: Solana is capable of processing more than 65,000 transactions per second (TPS), which is significantly higher than many other blockchains. This high throughput is achieved through a combination of innovations.

2. Proof of History (PoH): This is a unique feature of Solana. PoH is a cryptographic clock that enables the network to order transactions efficiently. By having a historical record that proves that an event has occurred at a specific moment in time, PoH helps to improve the scalability and efficiency of the network.

3. Scalability: Solana is designed to scale with Moore’s Law, meaning it can leverage improvements in hardware to increase its throughput and efficiency. This allows the network to maintain low transaction costs while handling more transactions as the hardware improves.

4. Low Latency: Solana aims to offer sub-second finality, which means that transactions are confirmed very quickly compared to many other blockchains. This is particularly useful for real-time applications such as trading and gaming.

5. Developer-Friendly: Solana offers various tools and frameworks to support developers in building and deploying decentralized applications. This includes support for smart contracts and various programming languages.

6. Ecosystem and Use Cases: The Solana ecosystem is growing rapidly, with numerous projects and applications built on its platform. These range from decentralized finance (DeFi) applications and non-fungible tokens (NFTs) to Web3 projects and gaming.

7. Token (SOL): The native cryptocurrency of the Solana blockchain is SOL. It is used to pay for transaction fees and staking, and it also plays a role in the governance of the network.

Overall, Solana aims to provide a scalable and efficient blockchain platform that supports a wide range of decentralized applications, addressing many of the limitations faced by earlier blockchain technologies.

Solana Price Prediction | How High Can Solana Price Go?

Predicting the future price of Solana (SOL) involves considering a range of estimates from various analysts and sources. Here are some key predictions for Solana in 2024:

1. Cryptonews anticipates that Solana could reach a potential high of $200, with an average price around $150 and a potential low of $80.

2. Beincrypto is more optimistic, predicting that Solana could surge to as high as $312.57 by the end of 2024 if bullish patterns continue. Their average price estimate for 2024 is approximately $178.

3. Changehero suggests that Solana might test resistance levels around $138.89, with potential highs around $200 if the bullish trend continues. They also mention a very optimistic scenario where Solana could reach $500, although this is less certain.

4. Coinweb provides a detailed month-by-month forecast for 2024, estimating that Solana could hit a high of $262.57, with an average trading cost around $224.4.

Overall, while predictions vary, the general consensus is that Solana is expected to perform well in 2024, potentially reaching new highs if market conditions remain favorable and key events, like Bitcoin’s halving and potential regulatory developments, positively impact the broader crypto market.

Solana Price Prediction Table

Here is a table of price predictions for Solana (SOL).

| Year | Average Price* | Percent Increase |

|---|---|---|

| 2024 | $250.99 | |

| 2025 | $286.75 | |

| 2026 | $324.89 | 73.97% |

| 2027 | $477.93 | 47.11% |

| 2028 | $695.11 | 45.44% |

| 2029 | $1,006.29 | -99.86% |

| 2030 | $1,444.29 | 0.00% |

| 2031 | $2,083.58 | 100.00% |

| 2032 | $3,122.71 | 50.00% |

| 2033 | $4,762.08 | 33.33% |

| 2040 | $25,655.58 | 525.00% |

| 2050 | $63,837.17 | 152.00% |

***Note that these are forecasts sourced from Changelly and average prices are subject to changes.

Can Solana reach $1000 dollars?

What are the Potential catalysts for Solana to reach $1000. Several factors could contribute to Solana reaching $1000 soon: Adoption by institutional investors: Increased institutional interest in cryptocurrencies could lead to significant inflows of capital into Solana, driving up demand and prices. But above all, if Solana ETF is approved, when we believe that Solana price will go very high. Solana ETF is possible because as we write this article, Ethereum ETF was approved by SEC including BlackRock and Fidelity!

Ethereum ETF approved Tweet!

BREAKING: SEC approves 8 Ethereum ETFs including BlackRock and Fidelity

— Frank Chaparro (@fintechfrank) May 23, 2024

SOLANA (SOL) PRICE PREDICTION & NEWS 2024 YouTube Video

Solana ETF News

If the SEC approves spot Ethereum ETFs, it will signify that they consider the second-largest cryptocurrency as a commodity, thus establishing an important precedent. This would be the first instance where a non-Bitcoin digital asset receives such a classification, creating anticipation for Solana to also be classified in a similar manner.

Earlier this week, the price of Ether saw an increase after Bloomberg analysts raised the probability of SEC approval for spot Ether ETFs from 25% to 75%. This change in likelihood came after reports that the regulator had requested updates to the filings. The SEC is expected to make their final decisions on these applications today, May 23, after experiencing several delays.

According to a report by Bernstein, Bitcoin’s price surged by 75% following the approval of spot ETFs. This suggests that Ethereum could experience a similar price movement once spot ETFs are approved.

If the SEC were to reject the applications, Ethereum may face considerable volatility and a significant price correction in the coming days, as suggested by research conducted by CryptoQuant.

During a recent interview on CNBC, crypto investor Brian Kelly shared a similar optimistic perspective on Solana and the potential approval of Ethereum ETF products by regulatory authorities. He speculated that SOL could potentially become the next altcoin to receive ETF approval, highlighting it as a strong contender for investment managers to promote.

Kelly emphasized that Bitcoin, Ethereum, and Solana are the three major digital assets that could see approval for ETF products in this cycle. He pointed out the success of Bitcoin ETFs, which have accumulated a substantial amount of Bitcoin, valued at approximately $58 billion. This demonstrates a high demand for regulated cryptocurrency investment products.

However, Kelly also recognized that there were some doubts among members of the Solana community. He pointed out that the initial coin offering (ICO) of Solana and its classification as a security by the Securities and Exchange Commission (SEC) could present difficulties in obtaining approval for an ETF.

Nevertheless, Kelly maintained a positive outlook and expressed optimism that the changing regulatory and political environment could improve the likelihood of Solana ETF approval, especially if Ethereum ETFs are given the go-ahead.