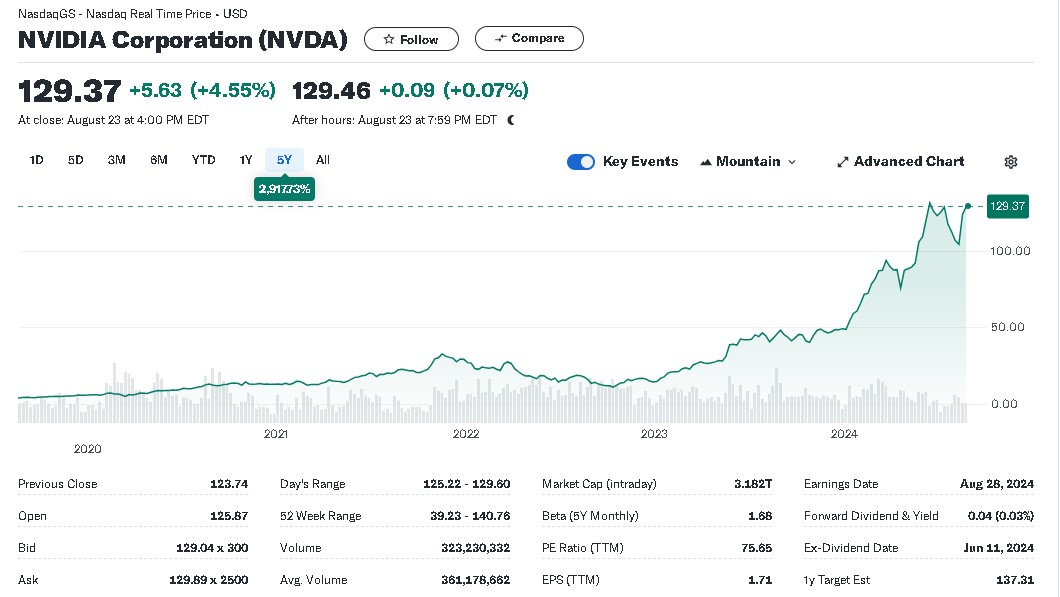

Nvidia company famous for its GPUs around the world used for AI, data centers, blockchain crypto mining, Data centers, cloud computing, Quantum computing, Gaming etc has become the standard for AI and GPUs. The company is releasing its next quarterly earnings on august 28 2024 after the market close. How will be the NVidia company’s quarterly earnings on august 28 2024? Will the Nvidia stock price go up or down after the coming earning results? Let us explain this in detail with some history.

Predicting the exact performance of Nvidia’s stock price after its quarterly earnings announcement on August 28, 2024, is inherently uncertain, as it involves various factors, including market conditions, investor sentiment, and company performance. However, I can provide some context and considerations based on historical trends and the company’s current situation.

Historical Context on Nvidia Company’s Quarterly Earnings

1. Past Earnings Reactions:

Nvidia’s stock has historically been quite reactive to earnings reports. For instance:

Q2 2023:

Nvidia’s stock surged significantly after reporting earnings that exceeded analysts’ expectations, driven by strong demand for its GPUs, especially in AI and data centers.

Q3 2023:

The stock experienced volatility due to mixed reactions over revenue guidance and market conditions. Nvidia’s strong performance in AI and gaming was offset by broader market trends and competitive pressures.

Q4 2023:

Nvidia saw positive stock movement after announcing strong revenue growth and advancements in its AI technologies.

https://sayoho.com/wp-content/uploads/2024/06/Best-Stocks-to-Buy-Now.jpg

2. Sector Performance:

Nvidia is a key player in the semiconductor industry, which has seen fluctuating performance based on broader economic factors, technological advancements, and supply chain issues. For example, during the semiconductor shortage in 2021, Nvidia’s stock saw significant gains, while in later periods, it faced challenges related to supply chain constraints and competition.

Current Factors to Consider on Nvidia Company’s Quarterly Earnings

1. AI and Data Centers:

Nvidia has been a leader in AI and data center technologies. The company’s performance in these areas has been a major driver of its stock price. If Nvidia continues to report strong growth in these segments, it could positively impact its stock.

2. Gaming Sector:

Nvidia’s gaming business is another key revenue driver. Market trends in gaming, including new product releases and overall consumer demand, will influence earnings.

3. Economic Conditions:

Broader macroeconomic factors, including inflation, interest rates, and global economic conditions, play a significant role. If economic conditions are favorable, investor sentiment might be more positive.

4. Competition:

Nvidia faces competition from companies like AMD and Intel. Developments in competitors’ technologies and market share can affect Nvidia’s stock price.

5. Guidance and Forecasts:

The company’s guidance for future quarters is crucial. Positive outlooks or revised forecasts can lead to stock price increases, while conservative or negative guidance can have the opposite effect.

Conclusion

Stock Price Movement: Based on historical trends, Nvidia’s stock tends to react strongly to earnings reports, often moving based on whether the results and guidance exceed or fall short of expectations. If Nvidia reports strong earnings and provides optimistic guidance, the stock is likely to rise. Conversely, weaker-than-expected results or cautious guidance might lead to a decline in stock price.

Historical Performance: Nvidia’s stock has shown resilience and growth in the face of strong performance in key areas like AI and gaming, but it has also faced volatility. Investors should keep an eye on earnings details and broader market conditions.

While these insights provide a framework for understanding potential stock movements, it’s essential to remember that investing in stocks involves risks and uncertainties. Consulting financial experts or conducting in-depth research before making investment decisions is always recommended.

Hence, we think Nvidia Will Deliver Record Results on Aug. 28, Which Will Supercharge the Stock Price.