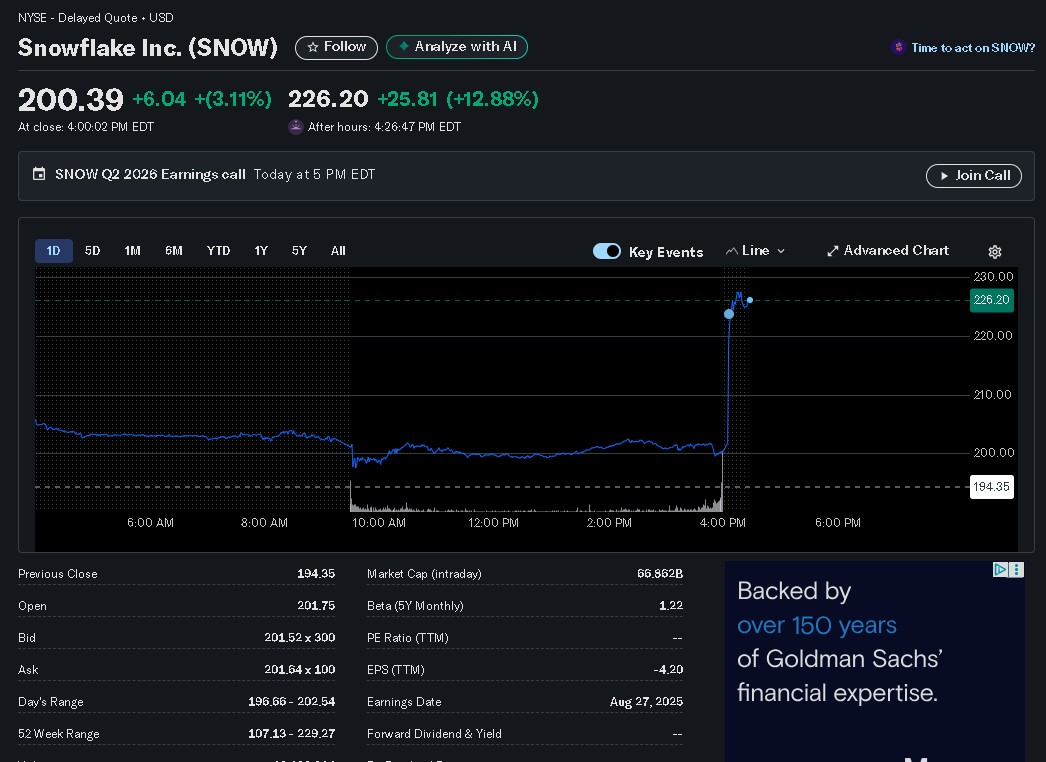

Snowflake (NYSE: SNOW) reported its Q2 FY2026 earnings after market close today, beating analyst expectations on both revenue and EPS while also raising full-year guidance. This sets up a potentially positive price reaction when trading resumes tomorrow, though volatility is common post-earnings for high-growth tech stocks like SNOW. Below, I’ll break down the key factors influencing my view, including actual results, historical patterns, market sentiment, and broader context.

Earnings Results vs. Expectations

- Actuals: Revenue came in at $1.15 billion (up 32% YoY), beating the consensus estimate of $1.09 billion. Adjusted EPS was $0.35, surpassing the expected $0.27. Product revenue hit $1.09 billion (up 32% YoY), with a net revenue retention rate of 125% and remaining performance obligations (RPO) at $6.9 billion (up 33% YoY). Non-GAAP operating income was $128 million, ahead of the $88 million forecast.

- Guidance: Snowflake raised its FY2026 product revenue outlook to $4.40 billion (from $4.33 billion) and adjusted free cash flow to $1.15 billion (from $1.10 billion). For Q3, product revenue is guided at $1.125–$1.130 billion (slightly above the $1.12 billion estimate), with a 9% non-GAAP operating margin.

- Key Highlights: CEO Sridhar Ramaswamy emphasized strong AI adoption, with over 6,100 weekly AI accounts and new features like Cortex Agent driving momentum. The company is expanding into industry-specific clouds (e.g., manufacturing, public sector), which could support long-term growth.

Pre-earnings consensus was optimistic, with analysts like BofA upgrading to Buy with a $240 price target, citing AI tailwinds and potential for 25–30% YoY growth. However, the actual beat was stronger than anticipated, particularly on margins and guidance, which could fuel upside.

Historical Post-Earnings Price Reactions

Snowflake has a mixed but often volatile history around earnings:

- Over the last 19 quarters (about 5 years), the stock has seen positive one-day returns 11 times and negative 8 times, with an average implied volatility (IV) crush of 29% post-report.

- Recent examples:

- Q1 FY2026 (May 2025): +13.4% (from $179 to $203)

- Q4 FY2025 (Feb 2025): +4.5% (from $166 to $174)

- Q3 FY2025 (Nov 2024): +32.7% (from $129 to $171)

- Q2 FY2025 (Aug 2024): -3.4% (from $135 to $131) Beats on revenue and guidance have typically led to gains of 5–30%, while misses or soft outlooks (e.g., margin pressure) have caused drops. Options pricing implied a ~7% move for this report, which the after-hours reaction has already exceeded.

Current Market Context and Sentiment

- Pre-Close Price: SNOW closed at around $194 today, up slightly in a choppy August (ranging from ~$192–$215). Year-to-date, it’s up ~27%, but trades at a premium valuation (15x forward sales vs. peers at ~14x), reflecting AI hype but also sensitivity to growth slowdowns.

- After-Hours Reaction: The stock jumped 10–11% immediately post-earnings (to ~$215–$220), signaling strong initial approval of the beat and AI momentum.

- Social Sentiment on X: Recent posts are overwhelmingly positive, highlighting the “double beat” and raised guidance. Traders and analysts are bullish on AI-driven growth, with comments like “riding AI hype” and upgrades emphasizing long-term outperformance. Some caution on high valuation and potential margin compression from AI infrastructure costs, but enthusiasm dominates. Broader market tailwinds, like Nvidia’s concurrent earnings beat, could amplify this if AI sector momentum continues.

- Analyst Views: Consensus remains positive, with forecasts for 18–27% annual revenue growth and improving EPS (to ~$1.00+ by FY2027). However, concerns linger over profitability, with adjusted gross margins slipping due to AI compute demands. Price targets range from $150–$440, averaging ~$220–$240.

Potential Price Movement Scenarios

Based on the earnings beat, historical patterns, and current sentiment, I expect a positive open tomorrow with 5–15% upside potential in the near term (targeting $205–$225 from today’s close). This assumes the AH gains hold and broader markets remain supportive amid AI enthusiasm.

- Bull Case (10–20% Upside): If the conference call (at 5 PM EST) reinforces AI traction and margin stability, SNOW could rally toward recent analyst targets ($240+). Strong beats have historically driven 10–30% pops, especially with raised guidance signaling sustained 25–30% growth.

- Base Case (5–10% Upside): Modest gains as the market digests the beat but factors in high valuation (172x forward P/E) and macro risks like potential rate cuts or tech sector rotation.

- Bear Case (Flat to -5% Downside): If questions arise on cost inflation, customer concentration, or softer AI adoption metrics, we could see profit-taking. Historical IV crushes suggest volatility could fade the initial pop, especially if broader indices pull back.

Overall, the results position SNOW well in the AI/data cloud space, but execution on margins and AI monetization will be key for sustained gains. This is not investment advice—markets can be unpredictable, and consider your risk tolerance.