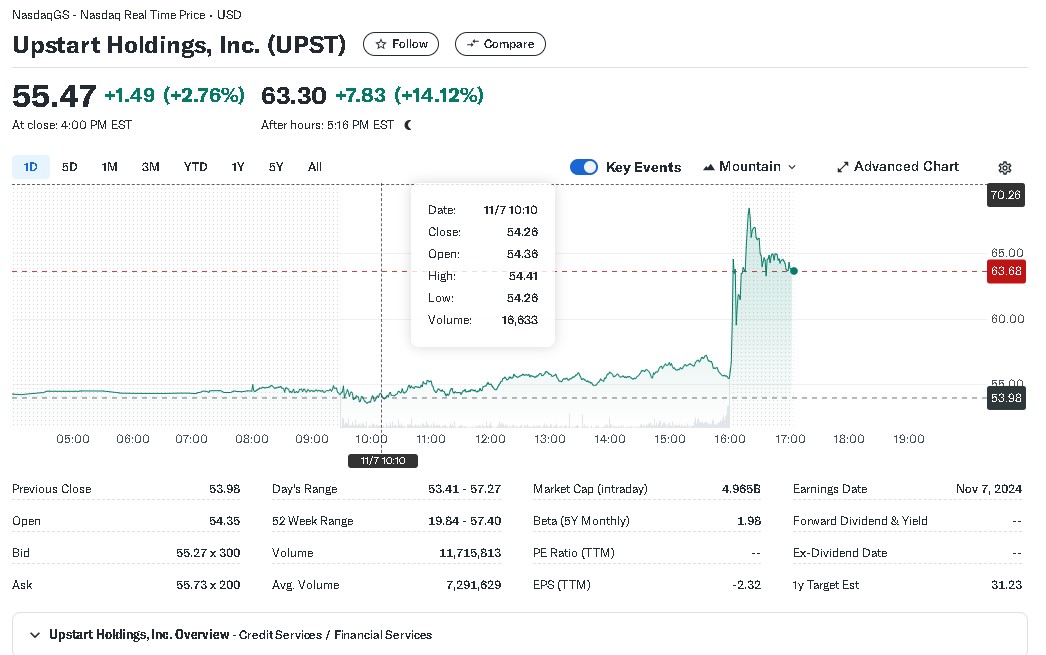

Before we start, we would like to remind our readers that the stock price of UPST was almost $400 in October of 2021 and with current favorable market environments, ongoing rate cuts in schedule and Trump’s tax cut policies, this stock could reach same height again.

Upstart Holdings, Inc. (NASDAQ: UPST), a prominent AI-driven lending marketplace, has released its financial results for the third quarter of fiscal year 2024, which concluded on September 30, 2024. The company will conduct a conference call and webcast at 1:30 p.m. Pacific Time today. A presentation of the earnings and a link to the webcast can be accessed at ir.upstart.com.

Third Quarter 2024 Financial Summary

Revenue: Total revenue for the third quarter of 2024 reached $162 million, reflecting a 20% increase compared to the same period in 2023 and a 27% sequential growth. Fee revenue totaled $168 million, marking a 14% year-over-year increase and a 28% rise from the previous quarter.

Transaction Volume and Conversion Rate: Upstart originated 188,149 loans during the third quarter, amounting to $1.6 billion in total transaction volume, a 30% increase compared to Q3 2023, and a 43% jump sequentially. The conversion rate for rate requests stood at 16.3%, up from 9.5% in the year-ago period.

Operating Income (Loss): The company reported an operating loss of $45.2 million, slightly higher than the operating loss of $43.8 million in Q3 2023.

Net Income (Loss) and Earnings Per Share (EPS): GAAP net loss was $6.8 million, a notable improvement from a net loss of $40.3 million in the third quarter of 2023. Adjusted net loss was $5.3 million, compared to an adjusted net loss of $3.9 million in the prior year’s third quarter. As a result, GAAP diluted earnings per share (EPS) was ($0.07), and the diluted adjusted EPS came in at ($0.06) based on the weighted-average shares outstanding for the quarter.

Contribution Profit: Contribution profit for the quarter was $102.4 million, reflecting a 9% year-over-year increase. The contribution margin was 61%, slightly lower than the 64% margin reported in the same quarter last year.

Adjusted EBITDA: Adjusted EBITDA for Q3 2024 was $1.4 million, down from $2.3 million in the year-ago period. The Adjusted EBITDA margin was 1% of total revenue, a decline from 2% in the third quarter of 2023.

Financial Outlook for Q4 2024

For the fourth quarter of 2024, Upstart anticipates the following financial results:

– Revenue: Approximately $180 million

– Fee Revenue: Approximately $185 million

– Net Interest Income (Loss): Around ($5) million

– Contribution Margin: Approximately 59%

– Net Income (Loss): Around ($35) million

– Adjusted Net Income (Loss): Approximately ($5) million

– Adjusted EBITDA: Approximately $5 million

– Basic Weighted-Average Shares Outstanding: Approximately 91.7 million shares

– Diluted Weighted-Average Shares Outstanding: Approximately 91.7 million shares

Upstart has not provided a reconciliation of the forward-looking non-GAAP metrics to their respective GAAP measures due to the uncertainty and potential variability in future costs and expenses. As such, a reconciliation is not available without unreasonable effort.

Key Operating Metrics and Non-GAAP Financial Measures

For more details on Upstart’s key operating metrics, please refer to the section titled “Key Operating Metrics” below. Additionally, reconciliations of non-GAAP financial measures to the most directly comparable GAAP results are provided at the end of this press release, alongside the accompanying financial data. For a description of these non-GAAP measures and an explanation of why management uses them, please see the “About Non-GAAP Financial Measures” section below.

Conference Call and Webcast Details

Upstart will host a live conference call and webcast at 1:30 p.m. PT on November 7, 2024.

To participate in the call:

– Within the U.S. and Canada: Dial +1 888-394-8218, conference code 8726199

– Outside the U.S. and Canada: Dial +1 313-209-4906, conference code 8726199

A webcast of the call will be available at [ir.upstart.com](http://ir.upstart.com).

Event Replay

A replay of the webcast will be available for one year at [ir.upstart.com](http://ir.upstart.com).

About Upstart

Upstart (NASDAQ: UPST) is the leading AI-driven lending marketplace, connecting millions of consumers with over 100 banks and credit unions. These partners utilize Upstart’s AI models and cloud applications to offer superior credit products. Upstart’s technology enables lenders to approve more borrowers at lower rates, across various demographics such as race, age, and gender, while providing a seamless digital experience that customers expect. Over 80% of loan applications are approved instantly, with no documentation required.

Founded in 2012, Upstart’s platform supports personal loans, automotive retail and refinance loans, home equity lines of credit, and small-dollar “relief” loans. The company is headquartered in San Mateo, California, with additional offices in Columbus, Ohio, and Austin, Texas.