What Is DEFI | Decentralized finance (DeFi) | FAQ With Video

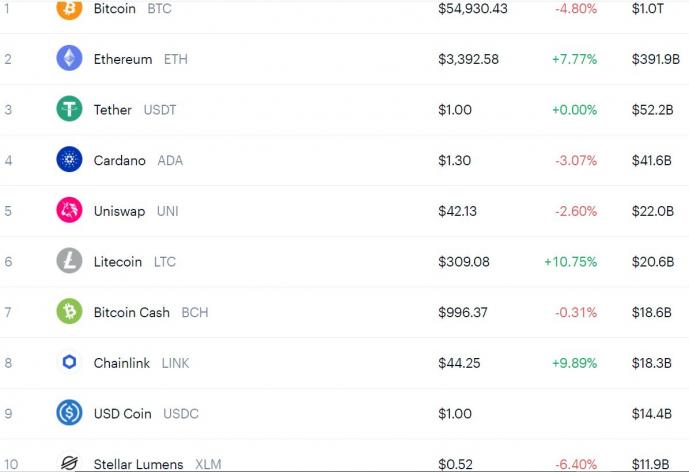

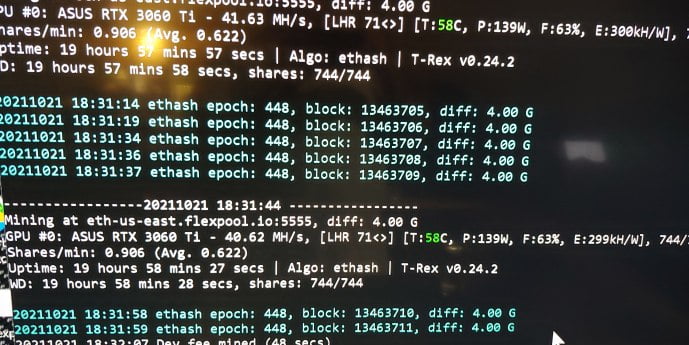

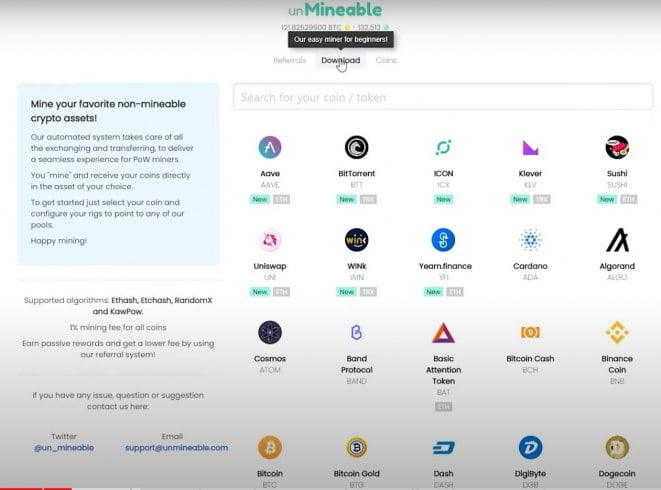

One space in cryptocurrencies attracting large consideration is DeFi or decentralized finance. Before we dive into this topic of What Is DEFI, we alos need to know traditional finance, components of DEFI, how DEFI can help this generation in regards with economics, finance, banking. This refers to financial providers utilizing smart contracts, which are automated … Read more