Introduction: What is Bitcoin?

Bitcoin is a type of digital currency that has no physical form and only exists on the internet. Bitcoin is not printed by any government or bank, but mined by computers solving complex math problems.

Bitcoin is simply an electronic currency which can be used to store and transfer value over the internet. Bitcoin uses peer-to-peer technology to operate with no central authority or banks; managing transactions and the issuing of bitcoins is carried out collectively by the network.

What is an Initial Coin Offering (ICO)?

An Initial Coin Offering, also known as ICO, is a fundraising mechanism in which new projects sell their underlying crypto tokens in exchange for bitcoin or ether.

The first step of an ICO starts with the development of a plan to present to investors. This plan includes marketing strategy, objectives, and financial expectations. A whitepaper is typically published before the ICO to outline the project’s goals and details on how funds will be used.

How to Invest in Bitcoin?

Bitcoin is a type of digital currency that has been taking off in the past few years. There are many reasons that lead people to invest in Bitcoin because it is one of the only cryptocurrencies to have a stable and increasing value.

There are three ways one can invest in Bitcoin. First, you can buy and sell your Bitcoins on an Exchange. Second, you can buy or mine new Bitcoins. Third, you can lend money and get paid interest rates on your Bitcoins while they work for you.

Investing in bitcoin is not as easy as it seems. It is important to understand what it can do for your investment portfolio.

In this article, we will discuss how to invest in bitcoin and provide a few use cases for bitcoin investment.

In addition, we will also have a look at the risks involved with investing in bitcoins and what you need to keep in mind when investing in bitcoins.

Bitcoin is a cryptocurrency and worldwide payment system. It can be used to buy and sell things and services in the world without any third party interference.

There are various ways to invest in Bitcoin, such as trading Bitcoin on an exchange, trading Bitcoin futures contracts, or investing in Bitcoin mining hardware.

Allocation: Investing in Bitcoin comes with a high risk of losing money due to its volatility. Investors should only invest what they can afford to lose because when they do lose money it is gone for good.

It is still risky to invest in Bitcoin, but there are ways to reduce the risk. Some of these are:

– Investing in Bitcoin through an IRA or 401k account – this reduces your risk by investing only what you can afford to lose.

– Conducting research on the company before you invest in them – if they have a long track record of success then investing may be worth it.

How to Trade Bitcoins?

The cryptocurrency trading platform is the most important thing for traders that want to trade cryptocurrencies. It should be a platform that offers a user-friendly interface and complete information about different coins available for trading.

This article will introduce a few of the most popular cryptocurrency trading platforms in order to help you identify the best one for your needs.

Bitcoin is the most popular cryptocurrency. It has been around for more than a decade now, and is worth more than $3,000 per coin. There are many popular exchanges which offer bitcoin trading in different forms.

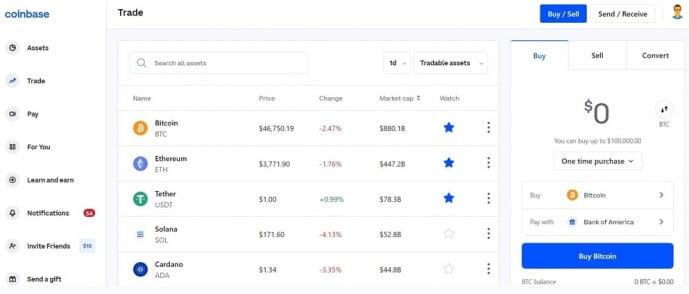

The most popular way to trade bitcoins is through cryptocurrency exchanges. These are sites where you can buy bitcoin with another currency or vice versa. They are the easiest way to get into the world of cryptocurrencies because you don’t need to buy bitcoins first in order to trade them.

Another option for buying bitcoins is through Bitcoin ATMs, though these are mostly available in big cities like New York City or San Francisco, and not in small towns with few people.

Bitcoin is the first decentralized digital currency, and it is an important form of online payment. Bitcoin transactions are made with no middle men – meaning, no banks!

A Bitcoin trading platform allows buyers and sellers of cryptocurrencies to come together for trading purposes. These platforms offer different order types, such as limit orders and market orders. To trade Bitcoins on a cryptocurrency trading platform like Coinbase, you need to open an account there.

Trading bitcoins is just like trading any other financial market and you will need a platform and a broker. The platform acts as the middleman between you and the broker, so it needs to be trustworthy.

You should never buy bitcoins from an unauthorized seller, not even if they offer to sell them for less than the market price. All transactions should be done through a registered bitcoin exchange or broker.

You can also trade Bitcoins through your wallet, however this requires identifying yourself. In order to avoid revealing your identity, trading directly with another person is preferred.

Bitcoin mining – how does it work?

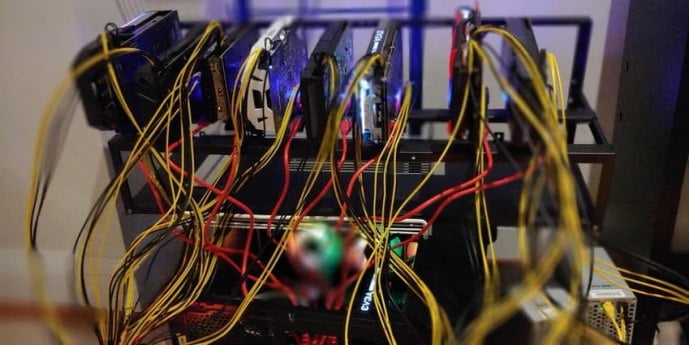

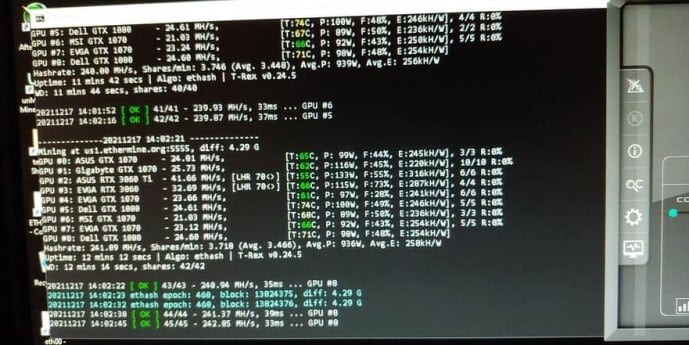

Bitcoin mining is a process that helps to confirm transactions on the blockchain and supports the cloud computing. In order to mine bitcoins, miners need to solve mathematical puzzles. The first miner who solves the puzzle gets a reward in bitcoins and then broadcasts it for all other miners in the network.

The process starts with joining a mining pool. This can be done by running a mining client on your computer or cloud service form a mining pool company. Once you have joined a pool, you can start solving blocks and earning rewards. You will also need to maintain your mining equipment to stay competitive in the industry.

Bitcoins are virtual money that can be mined through a process called mining. Bitcoins are generated when computers engage in solving mathematical problems. The more computing power you use, the more bitcoins you will mine.

The mathematical problems in bitcoin mining can be solved in two ways:

1) guesswork

2) use of cryptography.

Guesswork is an easy one because you just need to randomly try out different combinations of numbers until you find the right answer. But this method requires an awful lot of time and energy, making it impractical for most people to use it to mine bitcoins. This leaves cryptography which is much more effective than guesswork because it can solve these mathematical puzzles much faster than just guessing your way through them. The difficulty factor is defined by the number of digits in the puzzle, so it takes

Bitcoin mining is the process of adding transaction records to Bitcoin’s public ledger, which is called the blockchain. The miner uses a special software to solve cryptographic problems and so they are able to release new bitcoins.

The miners are people or companies that use their computers to validate transactions in order to collect their new bitcoins. Miners are awarded with new bitcoins for each successful block mined, which most often happens about every 10 minutes.

Bitcoin mining is the process of adding transaction records to Bitcoin’s public ledger of past transactions known as the blockchain. Mining is also the term used to refer to the electricity consumed by computer hardware in order to verify transactions on the blockchain.

The system rewards miners with bitcoins, which are then stored in a bitcoin wallet. The number of bitcoins that can be mined decreases over time and will eventually reach zero, making bitcoin mining unprofitable after some time.

The cost for mining bitcoins has gone down dramatically since 2011, when miners would spend $1000 on an ASIC (application-specific integrated circuit) chip that would use around 600 watts of power and generate less than 1 bitcoin per day ($0.40). Nowadays, hardware costs much less (around $1 per kilowatt) and its energy efficiency

What is a Bitcoin and Why Should You Care?

The total market capitalization of bitcoin alone is more than many companies on the S&P 500

Bitcoin is a digital currency, not issued by any central bank. It was introduced in 2009 by an unknown programmer or group that goes by the name Satoshi Nakamoto

The first bitcoin transactions took place in 2009. They were between Satoshi Nakamoto and Hal Finney, a developer and cryptographic activist who worked on PGP and wrote the first version of the Pretty Good Privacy (PGP) computer program

In January 2018, it became more expensive to purchase one bitcoin than an ounce of gold.

Bitcoin was the first decentralized digital currency and it paved the way for other digital currencies. It is a form of digital currency, created and held electronically.

Bitcoin has no central authority or middlemen such as banks or clearinghouses to manage transactions for users, hence it is called a decentralized digital currency. The peer-to-peer transactions can be done without an intermediary and these transactions are verified by network nodes and recorded in the blockchain ledger which cannot be altered or deleted.

Bitcoin is a digital currency – the first decentralized form of money. Bitcoin has captured the attention of many, because it’s not just a digital currency that can be traded with, but also an international payment system.

Bitcoin has only been around since 2008, but it’s already making waves in global finance. It’s not just for online purchases any more – Bitcoin is now being used to buy everything from homes to cars.

There are other digital currencies out there, like Ethereum and Litecoin; however Bitcoin is by far the most popular cryptocurrency. There are other reasons why Bitcoin might be considered better than its counterparts: it’s got the largest market cap (around $2 billion) and also boasts the most liquidity – meaning it’s easier to trade with than Ethereum or Litecoin.

Bitcoin is a digital currency that has been around since 2009. Bitcoin was designed to be a decentralized currency, meaning it’s not controlled by any centralized bank. With Bitcoin, you have full control over your money and transactions.

Bitcoin is the first cryptocurrency – digital currency that doesn’t rely on any government or institution to process transactions.

Investing in Bitcoin: The Basics You Need to Know

Bitcoin is a cryptocurrency that can be used to purchase items on the internet. A Bitcoin exchange is where you can buy and sell Bitcoin.

Bitcoin has grown in popularity over the years. This is partly because it has grown in value, peaking at $20,000 per Bitcoin in late 2017. Today, one bitcoin is worth about $11,000 – still a substantial amount of money. But what exactly are Bitcoins?

A Bitcoin exchange is an online marketplace for buying and selling Bitcoins with other users or institutions. These exchanges act as middle men between people who wish to buy or sell Bitcoins so they don’t have to directly engage in transactions with each other which would potentially incur high transaction costs.

Investing in Bitcoin can seem daunting at first, however, it is not as hard as one may think. There are a few things to consider before investing such as the bitcoin value chart and how long does it take to buy bitcoin.

Digital currency has been on the market for years now and many people have speculated about its potential for growth. Bitcoin is a cryptocurrency that has become increasingly popular in recent years and there are several reasons why this is true. You can use Bitcoin to make purchases online or offline and you can also invest in it if you believe that the price will rise.

There are many ways to purchase Bitcoin such as through an exchange or by purchasing them from someone who owns them directly. The easiest way to buy bitcoins is through an exchange such as Coinbase because they allow instant purchases with your cash/wallet.

Bitcoin is a type of currency that can be used for different purposes. It can be used as a store of value, as the currency itself, or even as an investment.

Bitcoin is similar to how other currencies are treated in that it has a fluctuating exchange rate with other currencies. There is also the risk of investing in Bitcoin because it does not have any form of government backing.

Investing in bitcoin can be a lucrative endeavor. The cryptocurrency is valued at $7,258 per bitcoin as of April 26, 2018.

Bitcoin is an open-source software project created in 2009 by someone using the name Satoshi Nakamoto. Bitcoins are not printed, like dollars or euros – they’re produced by people or companies running computers all around the world.

There are no physical bitcoins to keep safe like with traditional currencies. All you need to do know is find a vendor that accepts bitcoins and buy some if you want them. You can also buy bitcoin anonymously on exchanges like ShapeShift or Changelly without providing any personal information (though there may be limits on how much you can buy).

How Much Can You Earn Investing in Bitcoin?

Bitcoin is a digital currency and it is the first decentralized peer-to-peer payment network. It was invented by Satoshi Nakamoto. Bitcoin was invented as a new form of currency that would not be controlled by governments or banks.

The value of bitcoin fluctuates, and it is not backed by gold or government agencies. You need to buy bitcoin and store it securely in order to use it as a form of payment, and you can purchase bitcoin through exchanges like Coinbase.

If you’re wondering, “How much can I earn investing in bitcoin?” the answer is up to you.

People usually look at bitcoin as an investment opportunity, and while it may be a risky gamble, there are some calculators that calculate the potential profits one could make from their investment on bitcoin. If you want to know how much money you can make by investing on bitcoin, then here is a calculator that calculates your potential earnings.

Some people invest in Bitcoin because they want a way to supplement their income with a passive income. Others invest in Bitcoin because they know that it has been going up for years and they’re looking for even more profit. Still others invest in Bitcoin because they want to help create an alternative currency – or alternative economy – with Ethereum or Ethereum Classic.

Bitcoin has been around for a while now and has been one of the most profitable investments of the last decade. But how much can you earn investing in bitcoin? There are many ways to make money from bitcoin, but we need to take into account that we will be exposed to risk as well.

The potential profit is calculated by multiplying the number of bitcoins you own, with the current price per bitcoin and then dividing it by the number of bitcoins you invested.

Bitcoin is one of the most popular cryptocurrencies around. It was first introduced in 2009 by an anonymous group of programmers. Currently, there are over 1,500 different kinds of cryptocurrencies out there.

However, Bitcoin is still the most valuable cryptocurrency. The more traditional currencies are suffering from inflation due to government intervention and central banks’ monetary policy, whereas Bitcoin’s value is determined by its supply and demand on the market.

The gain or loss on a person’s investment varies depending on various factors such as time elapsed since they invested in bitcoin, the price of bitcoins when they first purchased it, how frequently they buy more bitcoins, etc.

The calculator helps you calculate your potential profit based on your investment amount and purchase dates.

How do I Buy Bitcoins? 4 Different Ways You Can Buy Bitcoins Online And Offline

Bitcoin is a digital currency and it is the first decentralized peer-to-peer payment network. It was invented by Satoshi Nakamoto. Bitcoin was invented as a new form of currency that would not be controlled by governments or banks.

The value of bitcoin fluctuates, and it is not backed by gold or government agencies. You need to buy bitcoin and store it securely in order to use it as a form of payment, and you can purchase bitcoin through exchanges like Coinbase.

If you’re wondering, “How much can I earn investing in bitcoin?” the answer is up to you.

People usually look at bitcoin as an investment opportunity, and while it may be a risky gamble, there are some calculators that calculate the potential profits one could make from their investment on bitcoin. If you want to know how much money you can make by investing on bitcoin, then here is a calculator that calculates your potential earnings.

Some people invest in Bitcoin because they want a way to supplement their income with a passive income. Others invest in Bitcoin because they know that it has been going up for years and they’re looking for even more profit. Still others invest in Bitcoin because they want to help create an alternative currency – or alternative economy – with Ethereum or Ethereum Classic.

Bitcoin has been around for a while now and has been one of the most profitable investments of the last decade. But how much can you earn investing in bitcoin? There are many ways to make money from bitcoin, but we need to take into account that we will be exposed to risk as well.

The potential profit is calculated by multiplying the number of bitcoins you own, with the current price per bitcoin and then dividing it by the number of bitcoins you invested.

When it comes to buying bitcoins, there are a variety of ways to do that. One way is through an exchange and the other is through OTC (over-the-counter) markets.

Exchanges:

Exchanges are marketplaces where you can buy bitcoins from other people. They keep a list of offers and bids from buyers and sellers and execute trades between them. The advantages of using exchanges are that they offer instant access to prices, they provide a platform for executing trades at the best prices, and you have a large number of people who can potentially buy or sell bitcoins near you. You just need to create your account on the exchange website, deposit money into your account by using PayPal or a credit card, place an order for Bitcoin is currently trading at a price listed by those who want to buy and sell it.

What are the Different Ways of Investing in Bitcoin?

While Bitcoin is a cryptocurrency, it can be treated as an investment or as a currency for making purchases. The decision of how to relate to Bitcoin depends on the individual and their expectations from the currency.

Investing in cryptocurrencies requires investors to be tolerant of significant price fluctuations and go through complicated processes to buy and sell them. Investing in stocks and other assets typically only involves the purchase and sale process.

Investing in bitcoin can be a great way to diversify your investment portfolio. In this article, we will explore the different ways that you can invest in bitcoin and what types of risks are involved with each type of investment.

Investing in Bitcoin is a relatively new asset class. As such, investing in it carries more risk than investing in something like stocks or mutual funds, although the potential for reward is much higher too. There are three main ways to invest in Bitcoin: buying bitcoins, trading bitcoins (short-term or long-term), and mining bitcoins.

Bitcoin is the most popular cryptocurrency. Investing in Bitcoin is one of the best ways to grow your wealth.

Investing in Bitcoin may seem difficult, but it’s actually not. There are three ways to do it – investing in stocks, investing in cryptocurrency, and mining bitcoins.

There are several ways of investing in Bitcoin with varying degrees of risk and reward. There are three common approaches – investing in stocks, trading cryptocurrency, or mining bitcoin yourself.

Investing in Bitcoin is a hot topic for many people. But what does it actually mean to invest in Bitcoin?

The simplest way to invest in Bitcoin is by buying it. This can be done by an individual or an organization with money. If you want to buy less than $100 worth of Bitcoin, we suggest using a service like Coinbase, which is an online-based cryptocurrency exchange and wallet provider. If you prefer not to use Coinbase, you can always use another peer-to-peer service like LocalBitcoins and Bitquick that allow buyers and sellers of Bitcoin to find each other on the site and transfer the bitcoins from one party to another.

In some cases, you can also earn Bitcoins through “mining” them as well as receiving small amounts from certain companies as payment for goods

How Much Money Do I Need to Invest

You don’t need to invest a lot of money in cryptocurrencies to be able to make profits. It’s important to understand that cryptocurrencies are not linked to the economy of any country, so you should expect the prices of cryptocurrencies to fluctuate drastically.

If you want to invest in cryptocurrencies, it’s best if you choose one cryptocurrency and buy it when its price is low. To decide which cryptocurrency you should focus on, take into account your risk tolerance and how much time you can spend researching each cryptocurrency before investing in them.

Section topic: How Blockchain Technology Connects Cars With Their Drivers

Section keywords: blockchain technology, cars, drivers

Introduction: Blockchain technology has been used by car manufacturers for quite some time now, but it will soon make its way

With the high cost of entry, many people are wondering about the minimum amount needed to start investing in crypto.

To answer this question, we need to know if you’re investing in the markets or using the coins for payments.

For crypto investment strategy, one has to determine their investment goals like short-term or long-term and decide on a portfolio strategy. There is no single best investment strategy for everyone – it all depends on what your risk tolerance level is and what your goal is.

If you are interested in investing in Bitcoin or any other cryptocurrency, you have to have some money to invest.

Investing in Bitcoin and other cryptocurrencies is a risky investment and can result in big losses as well as gains. The investment process is not the same for every person and depends on your financial situation and your risk tolerance.

The first thing you need to do before investing is setting a limit for yourself so that if the crypto market falls, you don’t lose more than this amount.

The amount of money one needs to invest in cryptocurrency is not the only factor that determines its success. The timing of investment is also very crucial. For example, if one invest in Bitcoin when it was valued at $5,000 and then it suddenly jumps to $20,000, the profit would be much higher than someone investing in Bitcoin when it was at $10,000. Another important factor is the risk tolerance levels of an investor. If one has a high risk tolerance level then they can invest more money but if they have a low risk tolerance level then they should invest less money in order to minimize their risks.

As you can see there are many factors that determine how much money you need for investing in cryptocurrency and each person’s situation varies so there isn’t a single answer to this

How Much Money Will I Make?

Making a profit in cryptocurrency is a long-term investment. The earlier you invest, the better chance you have of making good money.

Every person who invests in cryptocurrencies should have a plan on when they want to sell their digital assets. It’s crucial to know when the best time to sell is going to be, so that you can make sure that you maximise your profits and avoid losses.

When will I make money on my investment?

The answer to this question depends on the type of investment you are making. For example, if you invest in stocks, it may take anywhere from a few days to three months for you to see any return. If you invest in crypto, it can take anywhere from a day to 3 months or longer for you to see any return. With crypto specifically, tokens that are speculative in nature may never provide a return on your investment. In general, with blockchain-based projects and ICOs that have high risk factors, be prepared for the possibility of not seeing any return at all on your initial investment.

Investing in cryptocurrency is a risky endeavor, but it can also be profitable. In this post, we’ll talk about how much money you’ll make on your investment.

The term “investment” applies to any situation where you give up something now with the hope of getting more from it later. So if you buy an apple at a store and hope that by eating it now, you’re going to get more vitamins and fiber than if you had waited until later, then that’s an investment. If you buy a stock that pays dividends or returns your money in the form of cash payments over time, that’s also an investment.

“The ROI is the amount of money someone has made or will make on their investment. According to many, there are many different types of ROI, each with different levels of risk and return.”

To get a better understanding of how much money you will make on your investment, you should calculate the return on investment with cryptocurrency.

You can calculate the ROI for cryptocurrencies by dividing the increase in your cryptocurrency holdings by the sum of your original investment and all trading fees.

Cryptocurrency for Beginners – How To Start Investing In Crypto & Blockchain Assets And Why You Should!

Investing in cryptocurrency and blockchain assets can seem like a daunting task. However, the more people learn about this new technology, the more they want to invest in it.

The goal of this article is to provide some insight into the world of cryptocurrency and blockchain assets. We will cover topics such as how to invest, what to invest in, and why you should invest in crypto.

Cryptocurrency is a form of digital currency that has been created to work as an alternative to the fiat currencies that are used every day. It is only natural for people to start wondering when they should invest in cryptocurrency.

Since cryptocurrency is still in its infancy stage, it is not always easy to understand the nature of investing in crypto assets.

With this article, I will try my best to answer some questions about investing in cryptocurrency and blockchain assets so you have a clearer idea of what you are getting yourself into!

The cryptocurrency market has become a battlefield for investors. With so many cryptocurrencies being introduced to the market, not all of them are guaranteed to succeed.

This is why we need to understand the fundamentals and how blockchain can help with decision making in regards to investing in cryptocurrency.

Cryptocurrency and blockchain assets are great investments because they offer a lot of variety and also have a low barrier to entry even if you don’t have much money.

Section topic: How Blockchain Is Revolutionizing The Way We Bank And Pay For Things Online

Section keywords: online banking, online payments, security benefits of blockchain, use cases for blockchain technology

Blockchain technology is the world’s most secure database system because it is decentralized, meaning that there is no one person or group of people in control of the data. It operates like an open public ledger that nobody can edit after it’s been created.

Cryptocurrency is a new financial technology which has been generating a lot of interest. This article is going to guide you on how to invest in cryptocurrency and why you should do so.

As mentioned, the interest in cryptocurrency has been on the rise as more people buy into the idea of a decentralized currency. This trend has been accelerating as more and more retailers accept bitcoins as payment options. So, what are some reasons that can help convince you that this is a good time to invest?

The first reason is that the market for cryptocurrency trading is still relatively small compared to other investment opportunities like stocks and bonds. This means there’s plenty of room for price increases at this time before it becomes too crowded with investors.

Finally, there are many good reasons why investing in crypto assets might be a very wise idea.