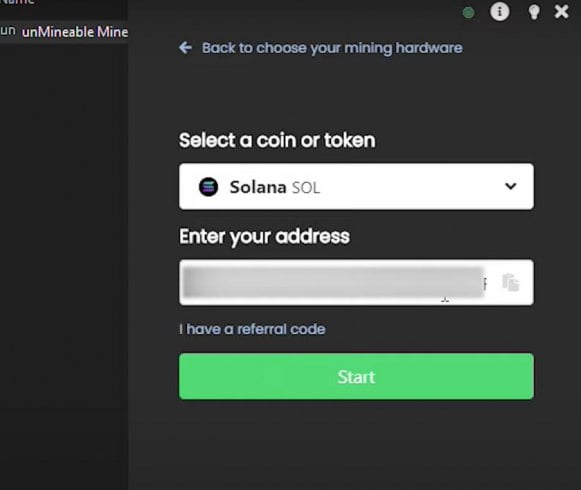

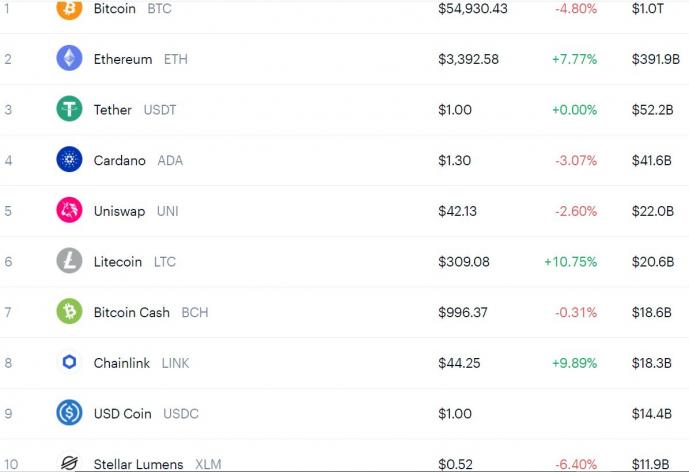

Solana Price Prediction | Solana ETF

Solana could surge to as high as $312.57 by the end of 2024 if bullish patterns continue. But before we talk about Solana price prediction, it is important to understand what is Solana blockchain and what Solana crypto does? Also like any other crypto currency, Solana is also very volatile as seen in below 5 … Read more